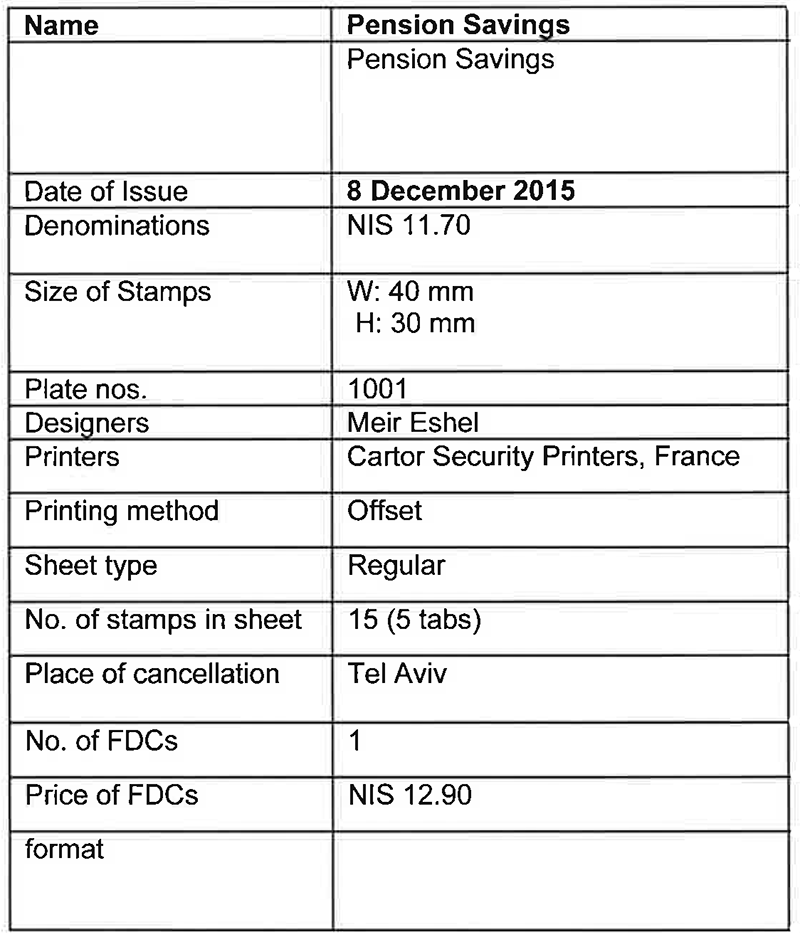

December 2015

Pension Savings is a comprehensive term for the provident and pension funds that ensure sufficient income after retirement. Most pension funds include a savings component and an insurance component that protects the client and his family in case of death or injury. The State of Israel decided to encourage pension savings by offering a significant tax benefit to employees.

Pension Savings is a comprehensive term for the provident and pension funds that ensure sufficient income after retirement. Most pension funds include a savings component and an insurance component that protects the client and his family in case of death or injury. The State of Israel decided to encourage pension savings by offering a significant tax benefit to employees.

Overall pension savings have increased from NIS 180 billion in 2001 to some NIS 600 billion in 2014. Thirty percent of pension savings are invested in designated government bonds, linked to CPI plus 4.8% interest. This growth significantly increased the inflow of funds to the Israeli stock market and has turned pension savings into a significant player in the Israeli capital market.

In 2003, the retirement age was raised in order to decrease government expenses and increase future pension payments. Today, pension fund clients are able to move their pension savings from one fund to another with no limitations.

Pension contributions have been mandatory for all employers and employees since 2008 – a step that added 1 million employees to the population of savers. Mandatory pension applies to all employees from age 21 for men and age 20 for women to retirement age.

In 2015, The Department of Capital Market, Insurance and Savings at the Ministry of Finance announced a planned reform in the pension savings market, which will include steps to reduce centralization and to increase competition, in view of the fact that the pension sector is the fastest growing sector in Israel’s financial market.